Origins of Degenomiks

In 2020, my life changed forever. I was riding high on my Robinhood account trading high-and tight-flags until the market crashed. I figured this was my moment to trade on values and fundamentals. Unemployment was the highest ever, inflation was out of control, and a global virus was killing everyone with unprecedented pace. I shorted the market.

During quarantine, market after market went into chaos. Labor markets had no workers. People were killing each other over toilet paper. Worst of all, my short position failed miserably. As time went on, the market got even crazier and I lost more money as I clung to my belief in fundamentals and the efficient market theory. Did I mention I lost more money?

What came afterwards was insult to injury, the proverbial kick-in-the-balls. Not only did the markets soar higher than ever, other more degenerate markets mooned. Shoes were selling for 10x what I normally paid for shoes. Dogecoin soared 100x to $1. Worse, JPEGS were selling for millions.

I snapped at JPEGS. I almost snapped at Dogecoin, but NFTs were the final straw. I decided I had to understand how this world worked and I went down a rabbithole to understand how something so utterly worthless could be worth so much. It led me down a career in Web3 where I traded these JPEGS full-time for 6 months that felt like 6 years.

In the end, after trading everything from breakdancing bears, anime wives, and apes smoking blunts, I felt qualified enough to speak out about my experience learning business on the streets, in the seedy section of the internet that even the degenerates from WallStreetBets looked down upon. And I brought back my own theories on what I call “Degenomiks” (someone already trademarked "Degenomics" with a c)

I paid $120,000 for an MBA only to watch magical internet money outperform the stock market.

— Douglas A. Boneparth (@dougboneparth) November 11, 2024

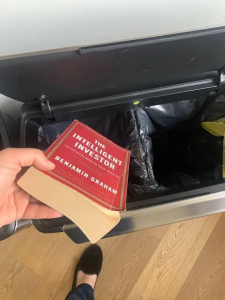

Ironically, when I surfaced to the real world and touched grass, I saw everything in a new light. I went to a top business school for undergrad and learned valuation methods from bankers and investors. Something unexpected happened. I saw the whole world as NFTs. Elite college degrees were NFTs. Real estate works like NFTs. Jobs were NFTs. Almost nothing functioned like a security when I actually stopped to think about it. I tossed my marked-up copy of “Intelligent Investor” by Benjamin Graham in the trash. It lost me too much money.

One cannot simply describe Degenomiks in just a short blog post, but here’s a teaser of my working principles:

- Markets are driven by emotions, community, and liquidity.

- People can't help it; even if they know it, they'll still do it.

- Price is not the same as value. Value is relative and abstract.

- People are degens. Non-degens are the exceptions not the rule.

- The most powerful economic forces are scarcity/status (extreme greed) and fomo (extreme fear).

- Value for everything is the scarcity driven value that you can bring to any market (e.g. business, labor, or dating).

- Applying degenomiks to your worldview helps you to explain the world. It's pretty funny as well. If you don’t laugh, the nihilism will get to you. Humor actually is a natural human way of coping with paradox and a sign of intelligence.

Disclaimer: This is not financial advice and do your own research. Also, if you are managing securities and actual investment with lots of money don’t move your or your clients money into JPEGS and Crypto. You will probably (most certainly) lose money.